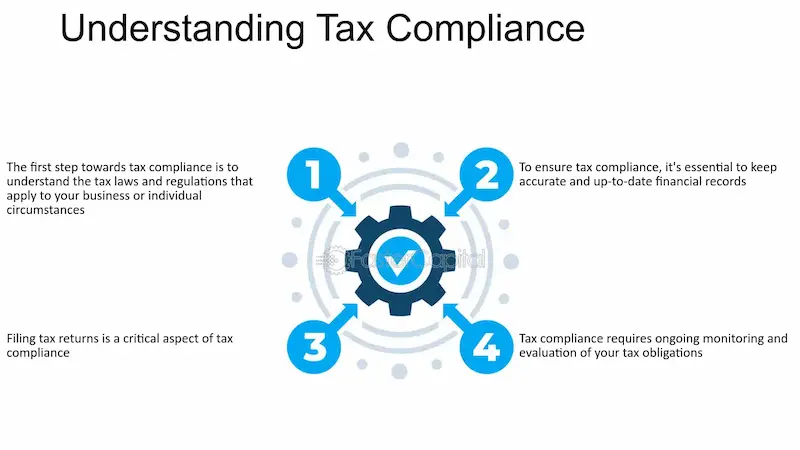

Understanding an income tax compliance guide is essential for individuals, freelancers, and businesses to stay legally compliant, avoid penalties, and manage finances efficiently. Compliance ensures timely filing, accurate reporting, and proper payment of taxes, which are critical for long-term financial health.

This guide explains the key rules, steps, and tips to meet income tax obligations while optimizing deductions and minimizing errors.

What Is Income Tax Compliance?

Income tax compliance refers to adhering to all legal obligations set by tax authorities, including:

- Timely filing of income tax returns

- Accurate reporting of income, expenses, and deductions

- Paying taxes due on time

- Maintaining proper financial records

- Following all applicable tax regulations

Non-compliance can result in fines, penalties, interest charges, or even legal action.

Why Income Tax Compliance Is Important

- Avoid Penalties and Interest

Late or incorrect filings lead to financial penalties and interest on unpaid taxes. - Ensure Legal Protection

Complying with tax laws reduces the risk of disputes with tax authorities. - Maximize Tax Benefits

Compliance allows individuals and businesses to claim all eligible deductions and exemptions. - Improve Financial Planning

Accurate tax reporting helps with budgeting, investments, and savings strategies. - Maintain Credibility

For businesses, compliance improves credibility with banks, investors, and partners.

Key Income Tax Compliance Requirements

1. Determine Filing Eligibility

Individuals, self-employed professionals, and businesses must file income tax returns if their income exceeds the taxable threshold defined by law.

2. Collect Required Documents

Maintain documents such as:

- Salary slips or income statements

- Bank statements and interest income records

- Investment proofs and insurance receipts

- Home loan or mortgage statements

- Business income and expense records

3. Accurately Report All Income

Include all sources of income:

- Salary, bonuses, and allowances

- Freelance or self-employment income

- Rental and investment income

- Capital gains

4. Claim Eligible Deductions and Exemptions

Reduce taxable income by claiming:

- Retirement fund contributions

- Health insurance premiums

- Education and tuition expenses

- Home loan principal and interest

- Charitable donations

5. Pay Taxes on Time

Calculate your tax liability based on income slabs and pay advance tax, self-assessment tax, or other required taxes before deadlines.

6. Choose the Correct Filing Method

- E-Filing/Online: Fast, convenient, and provides instant acknowledgment.

- Paper Filing: Accepted in some regions but slower and more error-prone.

- Professional Filing: Recommended for complex income sources or business filings.

7. Keep Accurate Records

Store all documents, returns, and proofs for 5–7 years to facilitate audits, disputes, or corrections.

8. Stay Updated on Tax Laws

Tax slabs, deductions, and compliance rules may change every financial year. Staying informed ensures you don’t miss new benefits or obligations.

You may also like to read this:

Financial Planning Tools: Track, Budget, and Plan Smartly

Tax Saving Calculator: Estimate Your Tax Savings Easily

Online Financial Tools: Track, Plan, and Manage Money Easily

Budget and Tax Tools: Plan Finances and Taxes Easily

How to File Taxes Correctly: Step-by-Step Guide

Common Mistakes to Avoid

- Missing filing deadlines

- Underreporting income or overstating deductions

- Poor record-keeping

- Ignoring advance tax payments

- Not updating knowledge on changing tax laws

Avoiding these mistakes ensures full compliance and reduces risks.

Tips for Income Tax Compliance

- Start planning early in the financial year

- Maintain organized and complete financial records

- Use accounting or tax software for accuracy

- Consult a tax professional for complex filings

- Review previous returns to ensure consistency and correctness

Conclusion

An income tax compliance guide is essential for individuals and businesses to stay legal, reduce financial risks, and optimize tax benefits. By following rules, maintaining accurate records, filing on time, and staying informed, taxpayers can simplify the process, avoid penalties, and plan finances effectively.

Compliance is not just a legal obligation—it’s a smart financial strategy that safeguards your future.

Frequently Asked Questions (FAQs) on Income Tax Compliance Guide

1. What is income tax compliance?

Income tax compliance is the process of adhering to all legal tax obligations, including accurate reporting, timely filing, and paying taxes due.

2. Who must follow income tax compliance rules?

Individuals, salaried employees, freelancers, self-employed professionals, and businesses must comply with tax regulations applicable to their income and activities.

3. Why is income tax compliance important?

Compliance helps avoid penalties, interest, or legal action, ensures eligibility for deductions, and improves financial planning and credibility.

4. What documents are required for income tax compliance?

Common documents include salary slips, bank statements, investment proofs, insurance receipts, home loan statements, and business financial records.

5. How can I ensure accurate tax reporting?

Report all sources of income, claim only eligible deductions, double-check all entries, and maintain supporting documentation.