Managing your finances effectively requires careful planning for both day-to-day spending and taxes. Budget and tax tools are online or software-based tools that help you track income, plan expenses, calculate taxes, and optimize your finances—all in one place.

Whether you’re an individual, freelancer, or business owner, using budget and tax tools makes financial management simpler, reduces errors, and helps you save money legally.

What Are Budget and Tax Tools?

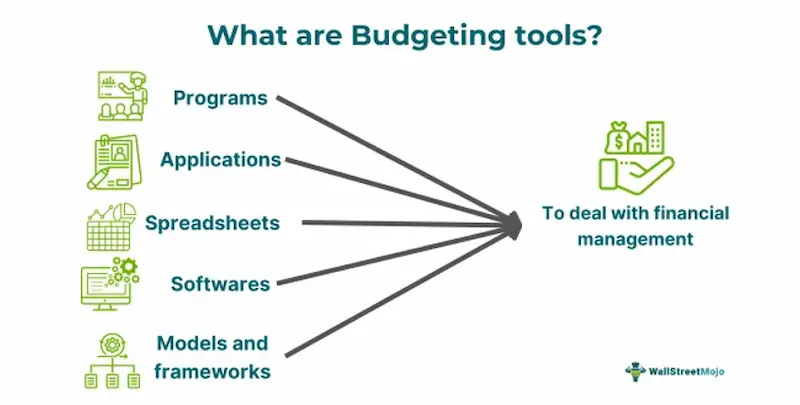

Budget and tax tools are digital platforms, apps, or software that help you:

- Track income and expenses

- Create monthly or yearly budgets

- Monitor savings and investments

- Estimate and plan for taxes

- Identify tax-saving opportunities

- Generate reports for better financial decisions

These tools combine budgeting and tax calculations to give a complete picture of your financial health.

Why Use Budget and Tax Tools?

Using budget and tax tools offers several benefits:

1. Simplified Financial Management:

Automatically track income, expenses, and taxes without manual calculations.

2. Accurate Tax Planning:

Estimate tax liability, identify deductions, and avoid surprises during filing season.

3. Better Budgeting:

Create realistic budgets based on actual income and expenses, helping you save more.

4. Goal Setting:

Set and monitor financial goals like emergency funds, home purchases, or retirement.

5. Reduced Errors:

Automation reduces mistakes in budgeting and tax calculations.

6. Time-Saving:

Quickly access reports, track finances, and make informed decisions without tedious paperwork.

Types of Budget and Tax Tools

Here are the main types of budget and tax tools available online:

1. Budgeting Apps:

- Track daily, weekly, or monthly spending

- Categorize expenses

- Examples: Mint, YNAB, PocketGuard

2. Tax Calculators:

- Estimate tax liability

- Identify eligible deductions and credits

- Examples: IRS Tax Withholding Estimator, free online tax calculators

3. Comprehensive Financial Tools:

- Combine budgeting, tax planning, and investment tracking

- Offer detailed reports and analytics

- Examples: Quicken, Personal Capital

4. Spreadsheets and Templates:

- Simple, customizable tools to track budgets and taxes

- Useful for small businesses or freelancers

5. Investment & Retirement Trackers:

- Plan long-term goals

- Track tax-saving investments and retirement contributions

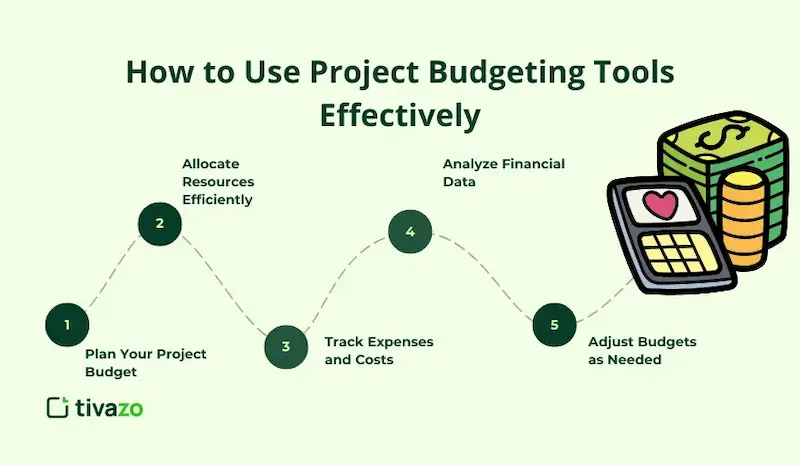

How to Use Budget and Tax Tools Effectively

- Gather Financial Information:

Collect details about income, expenses, investments, and tax documents. - Choose the Right Tool:

Select one that fits your needs—budgeting, taxes, or both. - Input Accurate Data:

Enter all income, expenses, and deductions carefully to ensure reliable results. - Set Clear Goals:

Define short-term and long-term financial goals for savings, investments, and tax planning. - Review Regularly:

Update income, spending, and investments monthly to monitor progress. - Use Multiple Tools If Needed:

Combine budgeting apps with tax calculators for complete financial control.

Benefits of Using Budget and Tax Tools

- Accurate tracking of spending and income

- Better planning for taxes and deductions

- Insights to reduce unnecessary expenses

- Helps save money legally through tax planning

- Improved financial awareness and control

You may also like to read this:

Tax Calculation Tools Online: Easy & Accurate Tax Estimates

Income Tax Calculator Free: Quick & Easy Tax Estimates

Financial Planning Tools: Track, Budget, and Plan Smartly

Tax Saving Calculator: Estimate Your Tax Savings Easily

Online Financial Tools: Track, Plan, and Manage Money Easily

Things to Keep in Mind

- Security: Use trusted platforms with strong data protection.

- Accuracy: Tools rely on precise data input for correct calculations.

- Updates: Ensure tools are updated with current tax laws and financial rules.

- Professional Advice: Consult a tax professional or financial advisor for complex situations.

Final Thoughts

Budget and tax tools are essential for anyone looking to manage money smartly, plan taxes effectively, and achieve financial goals. By combining accurate budgeting with proper tax planning, you can reduce stress, save money, and make informed decisions.

Using these tools consistently gives you a clear picture of your finances and helps secure your financial future.

FAQs About Budget and Tax Tools

1. What are budget and tax tools?

Budget and tax tools are online platforms, apps, or software that help track income, manage expenses, plan budgets, and estimate taxes efficiently.

2. Who can use budget and tax tools?

Anyone—individuals, freelancers, or business owners—can use these tools to manage finances, plan taxes, and optimize spending.

3. Are budget and tax tools free?

Many tools offer free versions for basic budgeting and tax calculations, while advanced features or comprehensive software may require subscriptions.

4. What types of budget and tax tools are available?

Types include budgeting apps, tax calculators, comprehensive financial planning software, spreadsheets, and investment or retirement trackers.

5. How do budget and tax tools help save money?

They help identify tax deductions, reduce unnecessary expenses, track investments, and plan budgets, allowing you to maximize savings legally.