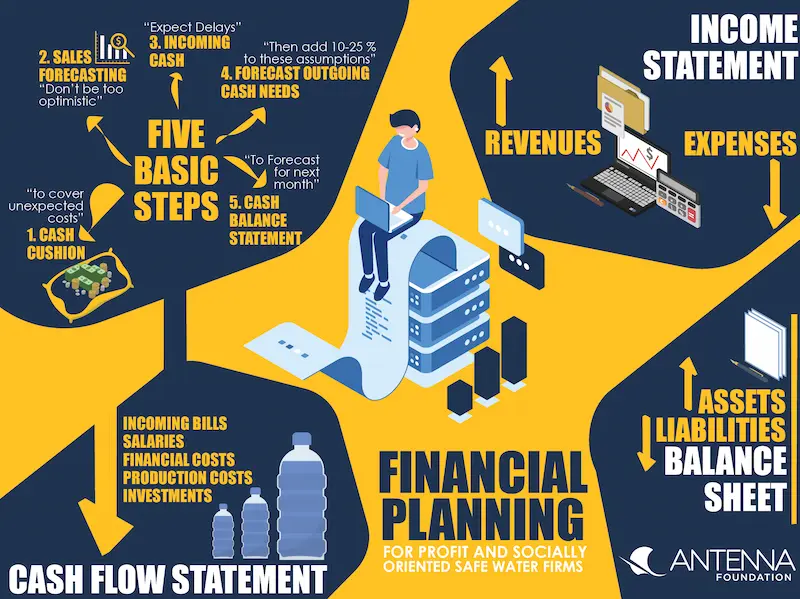

Managing money effectively is a challenge for many people, but financial planning tools make it easier to organize your finances, track expenses, and plan for the future. Whether you’re an individual, a freelancer, or a business owner, the right tools can help you make smart decisions, save money, and achieve your financial goals.

In this guide, we’ll explain what financial planning tools are, why they’re important, the types available, and how to use them effectively.

What Are Financial Planning Tools?

Financial planning tools are software, apps, or online platforms that help you manage your money efficiently. These tools allow you to:

- Track income and expenses

- Budget monthly or yearly

- Monitor investments and savings

- Plan for retirement or large expenses

- Analyze financial health

They simplify complex financial tasks, making it easier for anyone to manage money wisely.

Why Use Financial Planning Tools?

Using financial planning tools offers several benefits:

1. Better Budgeting:

Plan your spending and savings accurately to avoid debt.

2. Clear Financial Goals:

Set short-term and long-term goals, such as buying a home, education, or retirement.

3. Investment Tracking:

Monitor the performance of stocks, mutual funds, or other investments in one place.

4. Expense Tracking:

Know where your money goes each month and identify areas to save.

5. Tax Planning:

Some tools help track deductions and prepare for tax filing.

6. Decision Support:

Get insights to make informed financial decisions and avoid mistakes.

Types of Financial Planning Tools

Here are some of the most common types of financial planning tools:

1. Budgeting Apps:

Apps that help track income, expenses, and set monthly budgets. Examples: Mint, YNAB (You Need a Budget).

2. Investment Trackers:

Platforms to monitor your portfolio and analyze investment performance.

3. Retirement Calculators:

Tools that estimate how much you need to save to reach retirement goals.

4. Expense Trackers:

Simple tools to categorize and track daily, weekly, or monthly spending.

5. Comprehensive Financial Planning Software:

Software for individuals or businesses that combines budgeting, investing, tax planning, and goal tracking.

6. Online Spreadsheets and Templates:

Easy-to-use templates for tracking budgets, investments, and savings.

You may also like to read this:

Tax Calculation Tools Online: Easy & Accurate Tax Estimates

Income Tax Calculator Free: Quick & Easy Tax Estimates

Tax Saving Calculator: Estimate Your Tax Savings Easily

Online Financial Tools: Track, Plan, and Manage Money Easily

How to Use Financial Planning Tools Effectively

To make the most of financial planning tools, follow these tips:

- Gather Your Financial Information:

Collect details about income, expenses, debts, and assets. - Choose the Right Tool:

Pick a tool that matches your needs—budgeting, investing, or comprehensive planning. - Input Accurate Data:

Correct entries ensure accurate insights and reliable forecasts. - Set Clear Goals:

Define short-term and long-term financial objectives. - Review Regularly:

Update your financial information and review progress monthly or quarterly. - Use Multiple Tools If Needed:

Combine budgeting apps, investment trackers, and retirement calculators for a complete financial overview.

Things to Keep in Mind

- Security: Use tools that protect your personal and financial data.

- Accuracy: Tools are only as good as the data you enter.

- Updates: Choose tools that update tax laws, interest rates, or investment data regularly.

- Professional Help: For complex finances or investments, a financial advisor can complement these tools.

Final Thoughts

Financial planning tools are essential for managing money effectively, achieving goals, and making informed financial decisions. They save time, reduce stress, and provide clarity about your financial health.

By using the right tools consistently and inputting accurate data, you can stay organized, make smarter choices, and secure your financial future.

FAQs About Financial Planning Tools

1. What are financial planning tools?

Financial planning tools are apps, software, or online platforms that help track income, expenses, investments, and savings to plan your finances effectively.

2. Who can use financial planning tools?

Anyone—individuals, freelancers, or business owners—can use financial planning tools to budget, save, invest, and plan for financial goals.

3. Are financial planning tools free?

Many tools are free, such as basic budgeting apps or online calculators, while advanced features may require subscriptions.

4. What types of financial planning tools are available?

Types include budgeting apps, investment trackers, retirement calculators, expense trackers, and comprehensive financial planning software.

5. How do financial planning tools help manage money?

They provide insights into spending, track savings, monitor investments, calculate taxes, and help plan for short-term and long-term financial goals.