Tax saving strategies legally help individuals manage their finances smartly while staying fully compliant with tax laws. Paying taxes is a responsibility, but paying more than required due to lack of planning is avoidable. With the right legal approach, you can reduce your tax burden, increase savings, and achieve long-term financial security.

Whether you are a salaried employee, freelancer, or business owner, understanding tax saving strategies legally can make a significant difference in how much of your hard-earned income you keep.

What Are Tax Saving Strategies Legally?

Tax saving strategies legally refer to lawful methods allowed by tax authorities to minimize taxable income. These strategies include using deductions, exemptions, rebates, and approved investment options. Unlike tax evasion, which is illegal, legal tax saving follows government rules and ensures financial transparency.

The goal is not to escape taxes but to plan income and expenses wisely.

Why Legal Tax Saving Is Important

Using tax saving strategies legally offers several advantages:

- Reduces overall tax liability

- Improves cash flow and monthly savings

- Encourages disciplined financial planning

- Prevents penalties and legal complications

- Supports long-term wealth creation

Ignoring legal tax-saving opportunities often leads to unnecessary financial strain.

Common Tax Saving Strategies Legally Used by Individuals

Understanding available options is key to effective tax planning.

1. Invest in Retirement Plans

Contributing to retirement funds such as pension schemes or provident funds helps secure your future while offering tax benefits. These long-term investments are among the most reliable tax saving strategies legally.

2. Claim Health Insurance Benefits

Health insurance premiums paid for yourself and your family may qualify for tax deductions. This strategy provides both tax savings and financial protection against medical emergencies.

3. Utilize Education-Related Deductions

Expenses related to education or interest paid on student loans may be eligible for tax relief, making education planning a smart tax-saving move.

4. Home Loan Tax Benefits

Purchasing a home can provide tax advantages through deductions on loan interest and principal repayment. This is a popular and effective tax saving strategy legally.

5. Make Use of Approved Investment Schemes

Government-approved savings plans, bonds, and mutual fund investments often provide tax deductions while offering stable or long-term returns.

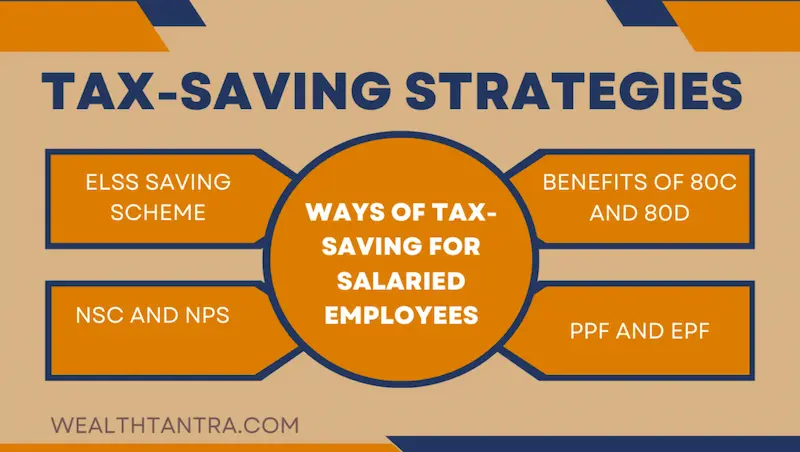

Tax Saving Strategies Legally for Salaried Individuals

Salaried individuals can reduce taxes through:

- Standard deductions and allowances

- Employer-provided benefits

- Retirement contributions

- Insurance and housing-related deductions

Proper planning ensures maximum utilization of available benefits.

You may also like to read this:

Tax Planning for Individuals: Smart Ways to Save Tax Legally

Best Tax Saving Ideas: Legal Ways to Reduce Taxes

Personal Tax Planning Guide: Save Taxes & Maximize Savings

Tax Planning for Small Businesses: Save Taxes Legally

Income Tax Planning Tips: Save Taxes Legally

Tax Saving Strategies Legally for Self-Employed Individuals

Self-employed professionals and freelancers have additional opportunities, including:

- Deducting business expenses

- Claiming depreciation on assets

- Writing off office rent, utilities, and travel expenses

- Professional training and development costs

Maintaining accurate records is essential to benefit from these strategies.

Mistakes to Avoid While Saving Taxes Legally

Even legal strategies can fail if not used correctly. Avoid these common mistakes:

- Waiting until the end of the financial year

- Investing only for tax benefits without considering returns

- Ignoring proper documentation

- Not reviewing tax laws regularly

- Overlooking eligible deductions

Smart planning avoids these pitfalls.

Role of Professional Tax Advice

Tax laws can be complex and frequently updated. Consulting a tax professional ensures that tax saving strategies legally are applied correctly and efficiently. Expert guidance helps maximize benefits while avoiding compliance issues.

How to Start Using Legal Tax Saving Strategies

Follow these simple steps:

- Understand your income sources

- Track expenses carefully

- Learn applicable tax laws and slabs

- Identify eligible deductions and exemptions

- Invest early and review annually

Consistency is the key to successful tax saving.

Conclusion

Tax saving strategies legally empower individuals to reduce tax liability while staying within the law. With informed decisions, early planning, and disciplined financial habits, you can save more, reduce stress, and build a secure financial future.

Choosing legal tax-saving methods not only protects you from penalties but also ensures that your money works smarter for your long-term goals.

FAQs

1. What are tax saving strategies legally?

Tax saving strategies legally are lawful methods used to reduce tax liability by using deductions, exemptions, rebates, and approved investment options allowed under tax laws.

2. Are legal tax saving strategies safe to use?

Yes, tax saving strategies legally are completely safe when followed according to government tax rules and regulations. They help avoid penalties and legal issues.

3. Who can use tax saving strategies legally?

Anyone earning taxable income—including salaried employees, freelancers, self-employed professionals, and business owners—can use legal tax saving strategies.

4. What is the difference between tax saving and tax evasion?

Tax saving strategies legally follow the law to reduce tax liability, while tax evasion is illegal and involves hiding income or submitting false information.

5. When should I start planning tax savings?

The best time to start using tax saving strategies legally is at the beginning of the financial year. Early planning offers more options and better financial outcomes.